child tax credit dates december 2020

15 opt out by Aug. The advance payments are half of the total so the couple will receive 500 250 per dependent each month until December.

What To Know About The First Advance Child Tax Credit Payment

The monthly payments were up to 250 or 300 per child for a period of.

. In 2022 they will file their 2021 return report the. For most families the agency relies on bank account information. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

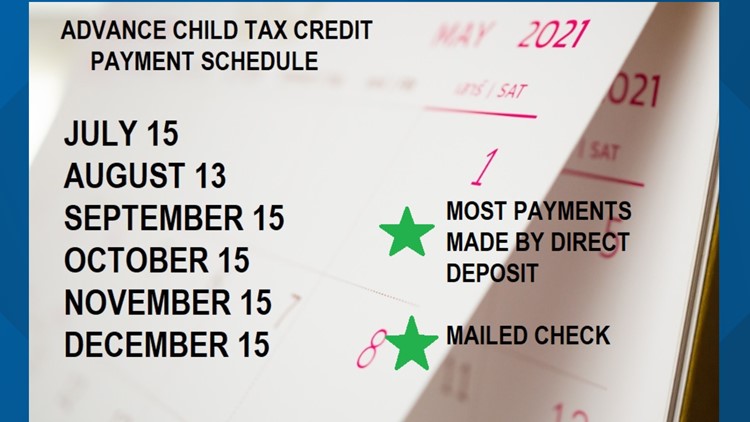

Benefit payment dates - Canadaca Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022. The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. Here are the official dates.

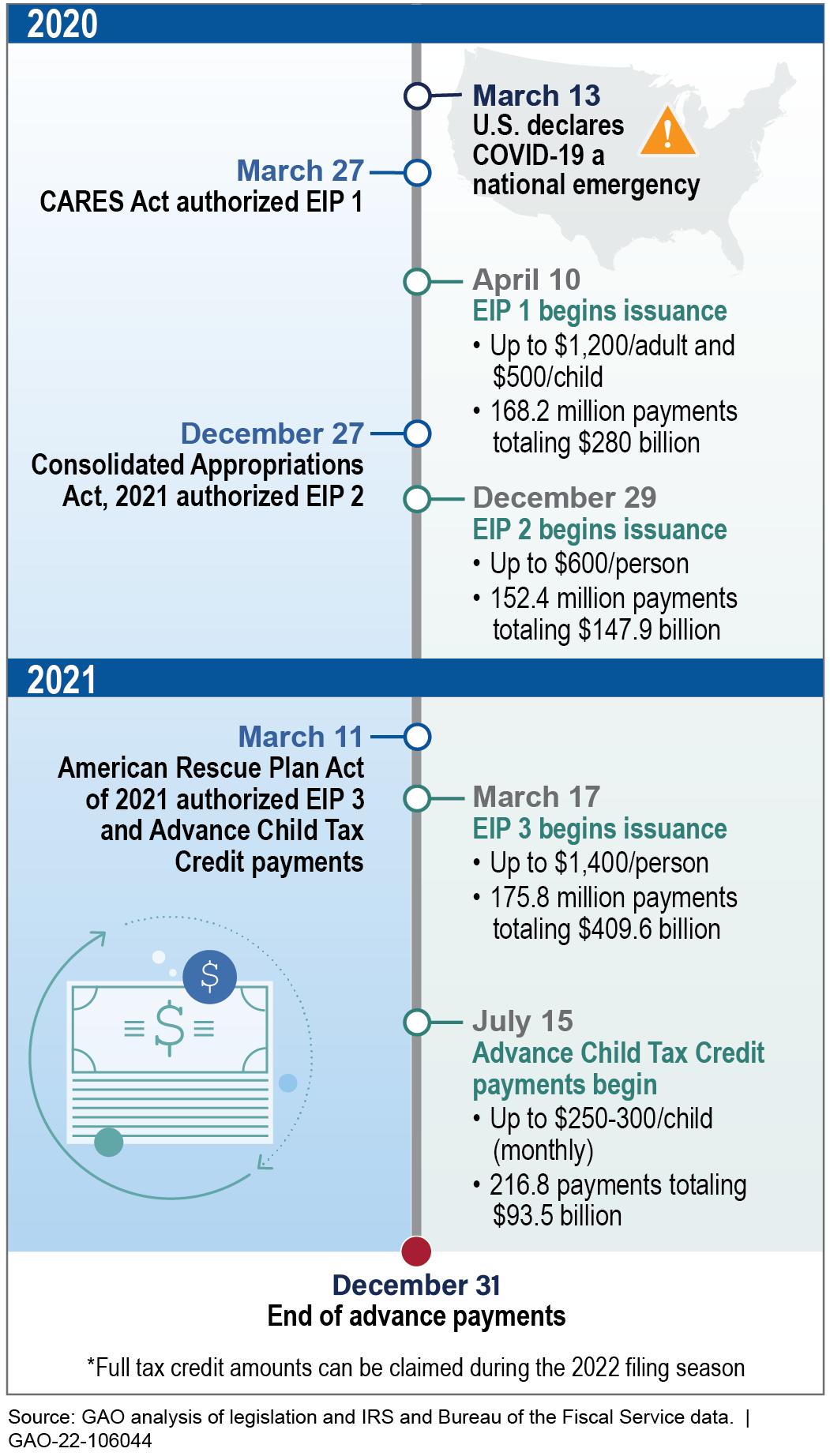

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. Advance payments of the enhanced child tax credits were sent to people from July to December 2021. It is a partially refundable tax credit if you had earned income of at.

Child Benefit is usually paid every four weeks on a Monday or Tuesday but if the payment is due on a Bank Holiday Child Benefit will usually be paid a day early. Your recurring monthly payments shouldve hit your bank account on the 15th of each month through December. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

From July to December 2021 parents were able to receive half of the child tax credit they qualified for based on their 2020 income in the form of monthly payments spread. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

Eligible families have received. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. From April 2020 to December 2021 the federal government made direct COVID-19 stimulus payments to.

To be a qualifying child for the 2021 tax year your. Who can get a COVID-19 stimulus payment or a Child Tax Credit. 15 The payments will be made either by direct deposit or by paper check depending on what.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600. It also provided monthly payments from July of 2021 to. Advance Child Tax Credit Find COVID-19 Vaccine Locations With Vaccinesgov COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments.

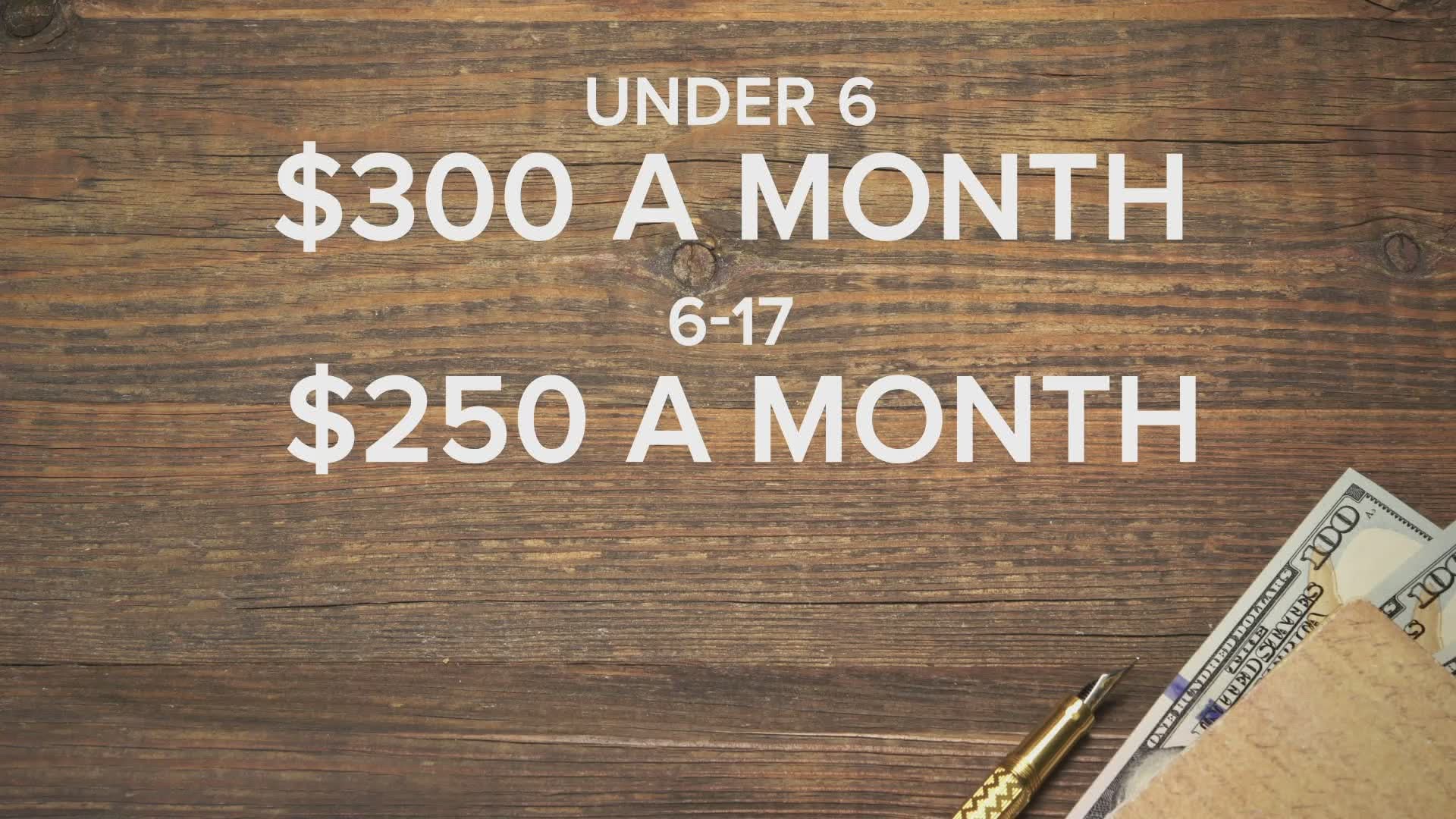

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

According to the IRS you can use the Child Tax Credit Update. Child tax credit by the numbers English Español IRS Tax Tip 2020-28 March 2 2020 Taxpayers may be able to claim the child tax credit if they have a qualifying child under. By August 2 for the August payment August 30 for the.

13 opt out by Aug. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit Payments Here Are The Dates You Ll Get Your Next Stimulus Payments Worth 900 Per Kid The Us Sun

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

What Is The Additional Child Tax Credit Turbotax Tax Tips Videos

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

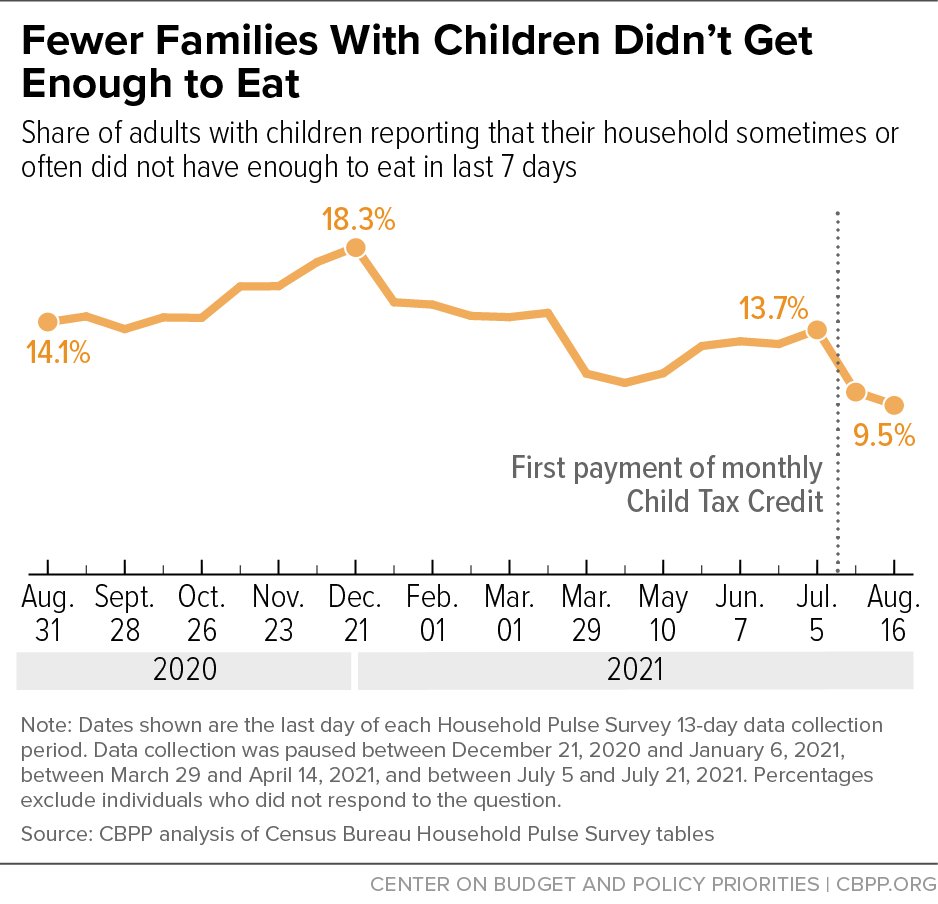

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat San Diego For Every Child

The Children S Trust To Help Families Cover Their Children S Basic Needs Congress Expanded The Child Tax Credit For This Year The Irs Will Be Sending Out Monthly Checks To Families With

What Is The Child Tax Credit Tax Policy Center

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit Here S What To Know For 2022 Bankrate

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Child Tax Credit Dates Last Day For December Payments Marca

Child Tax Credit Payment Schedule Here S When To Expect Checks Kare11 Com

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit How Many Payments Are Left Key Dates To Mark On Your Calendar Wpri Com

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx